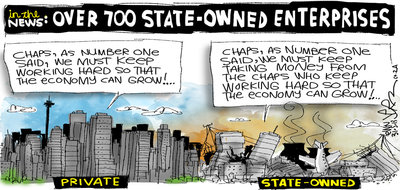

Privatize Our SOEs

Next Magazine (2015.01.01, A002, Second Opinion, Bill Stacey)

As we seek to heal the wounds of the political divide and show that “one country two systems” might have meaning, we could do worse than focus on removing more activities from the political realm. This is no more important than in the government’s far too extensive business interests.

Despite priding itself on market friendly policies, our government owns, or has shareholdings in large businesses that weigh heavily on the local economy, including the stock exchange, the MTR network and the Airport Authority. The government competes with the private sector in conference management, financial guarantees and parcel delivery. Although it is not a local terminology, it is fair to call these “state owned enterprises” (SOE’s). Like their counterparts in China, these businesses often have external shareholders, perhaps a stock market listing and increasingly they are seeking to expand outside Hong Kong.

However, they run on a tight leash. They cannot stray far from government policy, have boards dominated by government appointees and are a constant focus of political attention. Their main projects are reliant on government approvals and at every step of the project plan legislative and media scrutinies are applied. These businesses are also working increasingly closely with state sector counterparts in China.

Total revenue recorded by these SOE’s as a percentage of GDP is rising. Given our historic devotion to a “big market – small government” economics model, one would think the total revenue of China’s major SOEs would be higher in proportion to GDP than Hong Kong’s. Not true. China’s total revenue for the 300 largest SOE’s with external shareholders is 2.5% of GDP. Hong Kong’s SOE share actually accounts for more, at 3.4% of nominal GDP. The question must be asked, is increasing State ownership diminishing Hong Kong’s identity as a free market haven?

Whilst most of these SOE’s continue to record profits, logic and experience tell us that government involvement is a drag on overall productivity and these companies are less efficient in any given sector than if they are fully privatized hence invigorated and disciplined by market competition.Our local “SOE’s” have landed government performance in hot water. These businesses have been heavily criticized for failure to deliver projects within budget, on time and deliver on service commitments. Management is in the unenviable position of balancing politics with efficiency and frequently it is efficiency that is sacrificed. Problems inevitably occur when the owner and regulator are the same, creating conflicting incentives.There is no doubt that, with professional management, many of our partly government owned companies are fairly well run. The culture of our commercial traditions is infectious. However, this competence can’t be taken for granted as government’s meddlesome tentacles creep more widely.

One solution is for the government to recommence privatization of businesses. The historic track record is promising. Just look at the example of the Link Real Estate Investment Trust, which after its IPO in 2005 has transformed its shopping centers and car parking facilities.Not only has profit increased from $2.1 billion in 2006 to $18.4 billion in 2013, but The Link has reduced energy consumption by 20% compared to 2010 levels, it has partnered with local communities to improve the amenity of its facilities, dramatically improved governance; and most importantly improved the lives of the people of Hong Kong through a better service than what the government had ever provided while helping new businesses to grow.The government professes a desire to refocus attention on livelihood issues. It will be better able to do that if it simply gets out of these businesses. Increased meddling in what is rightfully the market’s business generates more fears that what makes Hong Kong unique is being eroded.Businesses interests tie up financial capital that could be better used and erode scarce political capital that is in short supply. Moreover, with SOE reform a priority elsewhere in China, it has presented us an opportunity to take the lead by offering, once again, a market-based economic model for all of the country.

Bill Stacey is in his 10th year as a resident of Hong Kong and is Chairman of theLion Rock Institute.We are now on Facebookhttp://www.facebook.