Revive the growth of our capital

(Next Magazine, 2015/10/08, A002, Second Opinion, Bill Stacey)

Revive the growth of our capital

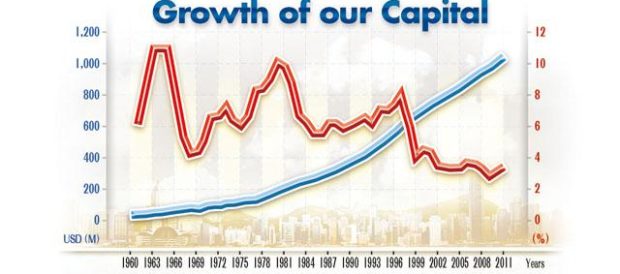

In a very real sense, we ride on the shoulders of our forefathers. We owe our prosperity to the patient building up of capital by the people who have come before us. Their patient saving and investment have delivered highly efficient companies, world-class infrastructure, great educational institutions that attract first-rate faculty from around the world, a well-educated populace and a distinctive culture. Our capital stock is now 25 times bigger than it was in 1960, but its growth has dropped considerably since the handover in 1997 (see chart).

The accumulation of our capital stock is not the result of a grand plan. Rather, it is the result of countless small decisions carefully made by individuals and businesses about little things that would make their lives easier or their businesses more efficient. For example, money exchange shops congregated in Sheung Wan initially to support the trading houses there, but now they give people competitive pricing off the street.It took some banks well over half of a century’s hard work to develop their branch network, an investment most would find difficult to replicate today. Even noodle shops took years to concoct the right recipe and create an ambiance that spawns loyal customers. Foundations for most of our hospitals, schools, churches and civil institutions were laid by contributions by countless people over generations. Less tangible, though by no means less important, is our culture that has nurtured a labor force that is practical, hard-working and single-mindedness about getting things done. This culture is fostered by a dedication to education and promoted by strong family values, it is a strength rarely found in most other parts of the world.

Capital does not have some permanent metaphysical existence. Technology and the world change, creating new capital, but also making some capital redundant. As we move to pooled fleets of self-driving cars running 24 hours a day, there is every chance that not only taxi investments but also many car parks will prove to be a use of capital no longer needed. That should encourage capital to move to higher value functions and in time make us all better off.It is hard enough for entrepreneurs to see and invest for the future, but regulatory decisions that hinder these changes are a dead-weight loss that keeps money invested pointlessly for purposes now redundant.Sitting on capital and extracting high yields for consumption, without reinvestment to maintain or grow businesses is a recipe for slower growth. Worse, capital can be consumed. It is consumed where resources are dedicated to uses that are unproductive, meet no human need and generate no cash flow. It is consumed when decisions drive resources from more productive uses. It is consumed by short-sighted decisions that do not lay the foundations for the future.

Consumption of capital rarely happens when people and entrepreneurs are left to their own devices and when market prices provide sensible signals about the value of investing for the future. So why has the rate of growth of our capital stock slowed so dramatically since the handover?Fundamentally, what it boils down to is too much focus on the short term, too many decisions that direct capital to unproductive uses and too much consumption of the financial, physical, human and institutional capital that we have inherited.Though we shouldn’t be rushing into judgment about such a decline, that it should happen after the handover is perhaps by no means coincidental. It is common knowledge that our post-colonial government has been intervention-prone, thus creating uncertainties that inevitably cloud the investment horizon. Political tensions between Hong Kong and the central government will, needless to say, have an adverse impact on businesses’ investment decisions.All in all, these are the dead-weight losses that have been slowing down the growth of our capital stock. Left unchecked this trend will harm the prospects of our children. Our government can help to reverse this deplorable trend by exercising greater self-restraint.

Bill Stacey